Loading

Get V1-dep 2019 2020 Verification Worksheet Dependent Student

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the V1-DEP 2019 2020 Verification Worksheet Dependent Student online

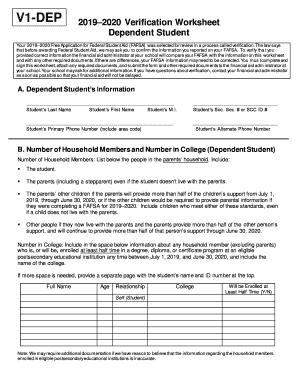

Filling out the V1-DEP 2019 2020 Verification Worksheet for dependent students is an essential step in the Federal Student Aid application process. This guide provides detailed instructions to help users comprehensively complete the form online, ensuring accuracy and compliance.

Follow the steps to complete the verification worksheet successfully.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- In section A, input the dependent student’s information, including their last name, first name, middle initial, Social Security number or SCC ID, primary phone number, and alternate phone number.

- Move to section B to specify the number of household members and those enrolled in college. List each household member including the student, their parents (and stepparent), and any siblings or others who live in the household and receive more than half of their support from the parents.

- Fill out the number in college subsection for any household member, excluding parents, who will be enrolled at least half-time in a postsecondary institution from July 1, 2019, through June 30, 2020. Provide their full name, age, relationship to the student, the college’s name, and indicate if they will be enrolled half-time or more.

- Proceed to section C if the student filed a 2017 tax return. If applicable, check the appropriate box indicating whether the IRS Data Retrieval Tool was used, your plans to use it, or if you will provide a Tax Return Transcript or signed copy of the 2017 IRS tax return.

- In section D, follow similar instructions for the parents' income verification if they filed a 2017 tax return. Indicate whether the IRS DRT was used or provide the necessary tax return documentation.

- If the student or parents have unusual circumstances stated in section E, provide the requested documentation and check the appropriate boxes as instructed.

- In sections F and G, if the student or parents did not file a tax return, check the applicable boxes and list the names and income of employers, if any. Provide documentation regarding non-filing as required.

- Finally, complete section H by having both the student and a parent sign and date the worksheet, certifying that the information provided is accurate and complete.

- After filling the form online, ensure to save any changes, then proceed to download, print, or share the completed verification worksheet as necessary.

Complete and submit your V1-DEP 2019 2020 Verification Worksheet online to ensure timely financial aid processing.

V1—Standard Verification Group. Students in this group must verify the following if they are tax filers: Adjusted gross income. U.S. income tax paid. Untaxed portions of IRA distributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.