Loading

Get Canada T1261e 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1261e online

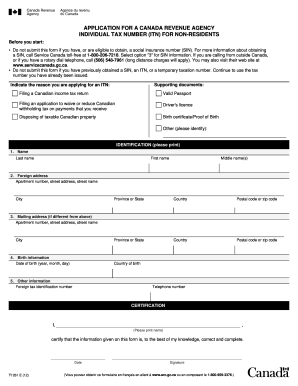

This guide provides step-by-step instructions on completing the Canada T1261e form online, which is essential for non-residents applying for an individual tax number (ITN). Follow these instructions to ensure a smooth application process.

Follow the steps to accurately complete your application for an ITN.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate the reason for applying for an ITN by checking the appropriate box on the form. Options include filing a Canadian income tax return or disposing of taxable Canadian property.

- Fill in your legal name in the identification section, providing your last name, first name, and middle name(s) as they appear on your supporting documents.

- Enter your foreign address, including the apartment number, street address, city, province or state, country, and postal code or zip code.

- If applicable, provide a different mailing address so the Canada Revenue Agency can send your documents back to you.

- Record your date of birth in 'year/month/day' format, as well as your country of birth in the designated section.

- Input your foreign tax identification number and telephone number to complete your contact information.

- Review all entered information for accuracy and completeness.

- Sign the certification section, providing your printed name and the current date.

- Once you have filled out and signed the form, choose to save changes, download, print, or share the completed form as needed.

Begin your document preparation and complete the Canada T1261e online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When a Canadian sells a house in the USA, they must consider potential capital gains taxes imposed by the IRS. This process requires careful reporting on US tax returns, as well as interactions with Canadian tax rules. It's essential to consult with tax professionals to fully grasp your obligations in both countries. Platforms such as USLegalForms specialize in providing tools to navigate these complex tax issues effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.