Loading

Get Chuna Sacco

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Chuna Sacco online

This guide provides comprehensive instructions on how to fill out the Chuna Sacco loan application form online. Follow the steps carefully to ensure your application is completed accurately.

Follow the steps to successfully complete your loan application.

- Click 'Get Form' button to access the Chuna Sacco loan application form.

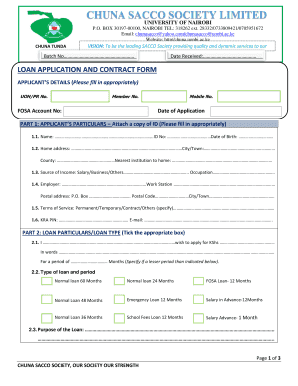

- Fill in the applicant’s details, including UON/PR No, member number, FOSA account number, mobile number, and date of application. Make sure to input accurate personal information.

- In part 1, provide your personal particulars like your name, ID number, date of birth, home address, city/town, county, nearest institution, source of income, occupation, employer details, and KRA PIN.

- In part 2, specify the loan particulars. Indicate the amount you wish to apply for, both in figures and words, as well as the period for repayment.

- Select the type of loan you are applying for by ticking the appropriate box. Specify the purpose of the loan in the designated space provided.

- In part 3, indicate any loans you wish to clear through Chuna and provide details of outstanding amounts along with relevant statements if needed.

- Fill out the part regarding guarantors, providing at least the necessary details for the required number of guarantors, including signatures.

- In part 5, list any personal commitments you are pledging as security and authorize modifications to your share contributions if applicable.

- Review the general terms and conditions in part 6, ensuring you understand the requirements and obligations involved in taking out a loan.

- Complete part 7 about specific terms for FOSA loans if applicable, providing the necessary information about your salary passing through CHUNA FOSA.

- Once all fields are filled accurately, save changes and choose to download, print, or share the completed form.

Complete your loan document online to take the next step towards ensuring your financial needs are met.

One of the main objectives of Saccos is to offer members a way of accessing credit by allowing them to borrow up to three times against their savings. The amount that members contribute every month is used to provide loans to other members. In turn, the debtor is charged interest that is distributed among members.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.