Get Canada Ct23 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada CT23 online

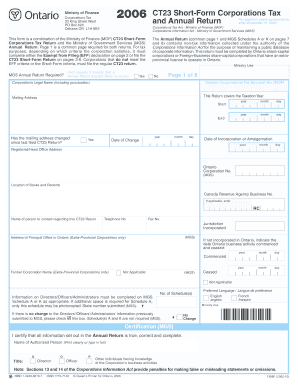

Filling out the Canada CT23 online can seem daunting, but this guide provides a clear and structured approach to ensure you complete the form correctly. This guide will walk you through each section and field of the CT23 Short-Form Corporations Tax Return, helping you to navigate this important tax document with confidence.

Follow the steps to successfully complete the Canada CT23 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by filling in the corporation’s legal name and Ontario Corporations Tax Account Number on page 1 of the form. Make sure the information is accurate and inclusive of any necessary punctuation.

- Indicate the taxation year end by providing the year, month, and day. Keep this date consistent with your corporation's financial records.

- If your mailing address has changed since the last CT23 Return, check 'Yes' and provide the date of the change along with the new mailing address. Otherwise, select 'No'.

- You will need to complete the section regarding the corporation's directors/officers. If there are no changes to the previously submitted information, simply check the relevant box.

- For corporations applying for an Exempt From Filing declaration, fill out the relevant details on page 2, including the corporation's mailing address and Ontario Corporation Number.

- Determine if your corporation meets the criteria for the CT23 Short-Form Return by answering the qualifying questions on pages 3-4.

- Calculate total income tax payable according to the instructions and provide necessary supporting documents such as schedules if required.

- Complete the certification section by having an authorized person sign and date the return, confirming the accuracy and completeness of the information provided.

- Finally, save your changes. You can download, print, or share the completed form as needed.

Start completing your Canada CT23 form online today to ensure timely and accurate submission!

Get form

Related links form

Yes, Canada has an equivalent to the IRS known as the Canada Revenue Agency (CRA). The CRA is responsible for tax collection, compliance, and the administration of various federal tax laws. They handle income taxes, including self-employment taxes reported on forms such as the Canada CT23. If you need assistance understanding your tax obligations, services provided by US Legal Forms can be an invaluable resource.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.