Loading

Get Form Gst Reg-25 Certificate Of Provisional Registration - Tampcol

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form GST REG-25 Certificate Of Provisional Registration - Tampcol online

Filling out the Form GST REG-25 is an essential step in obtaining provisional registration under the Goods and Services Tax system. This guide will help you navigate through the form effectively and ensure that all necessary details are accurately filled out.

Follow the steps to complete your Form GST REG-25 online

- Press the ‘Get Form’ button to access the form and launch it in your preferred digital document management software.

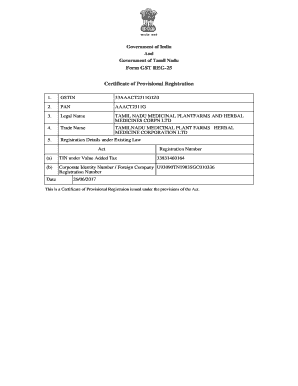

- Begin by filling in the GSTIN field. This number is crucial as it identifies your business under the Goods and Services Tax system.

- Next, enter your PAN (Permanent Account Number) in the designated field. The PAN is essential for verification and identification purposes.

- Provide the legal name of your organization as registered. Ensure this matches the name on official documents for consistency.

- Input the trade name of your business. This is the name you operate under and may differ from your legal name.

- For registration details under existing law, fill in the TIN under Value Added Tax if applicable. This should reflect your existing registration number.

- Enter your Corporate Identity Number or Foreign Company Registration Number, ensuring to capture this accurately as it is critical for regulatory purposes.

- Finally, confirm the date of your registration under the existing law by inputting the correct date in the specified format.

- Once all fields are filled out accurately, review your entries for any errors. After confirming everything is correct, you can choose to save your changes, download a copy, print the form, or share it as needed.

Complete your Form GST REG-25 online and ensure your registration is processed without delay.

The rules state that the applicant shall acquire attestation from an authorized signatory and resident of India with valid PAN. Hence, once the authorised signatory is engaged, Indian GST registration process can be started for non-resident taxable persons (NRIs).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.