Loading

Get T2222 Form 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T2222 Form 2018 online

Filling out the T2222 Form 2018 online allows individuals to apply for northern residents deductions efficiently. This guide provides a step-by-step approach to ensure you accurately complete each section of the form to maximize your potential tax benefits.

Follow the steps to successfully complete the T2222 Form 2018 online.

- Click ‘Get Form’ button to download the T2222 Form 2018 and open it in your preferred editor.

- Indicate your residency. Specify Zone A for a prescribed northern zone or Zone B for a prescribed intermediate zone. Enter your current address, province or territory, and the continuous period of residency (minimum of 6 consecutive months).

- Calculate your residency deduction by completing the two parts: a basic residency amount for the number of days lived in a prescribed zone and an additional residency amount if applicable. Be mindful of the conditions regarding shared residency deductions.

- Provide details about any special work sites if applicable. If you worked in a prescribed zone under specific conditions, you may qualify for additional deductions.

- List the names and addresses of individuals who lived with you during the corresponding tax year. Complete the travel benefits section by calculating and entering the taxable travel benefits received from your employer, along with expenses for each trip taken.

- Total your northern residents deductions by adding your residency deduction and the deduction for travel benefits. Make sure to enter this total in the designated line of your tax return.

- Save your changes, download a copy of the completed form, print it if necessary, or share it as required.

Begin filing your T2222 Form 2018 online today to claim your northern residents deductions.

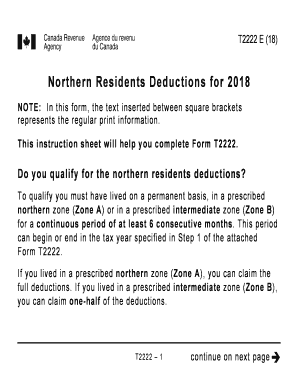

You qualify if you lived on a permanent basis in a prescribed northern zone (Zone A) or prescribed intermediate zone (Zone B), for a continuous period of at least six consecutive months. This period can begin or end in the tax year specified in Step 1 of Form T2222, Northern Residents Deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.