Loading

Get Exemption (r&t Code)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EXEMPTION (R&T CODE) online

Filling out the EXEMPTION (R&T CODE) online is a straightforward process that enables users to manage their tax documentation efficiently. This guide will walk you through each section of the form, providing clear and supportive instructions to ensure accurate completion.

Follow the steps to fill out the EXEMPTION (R&T CODE) form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

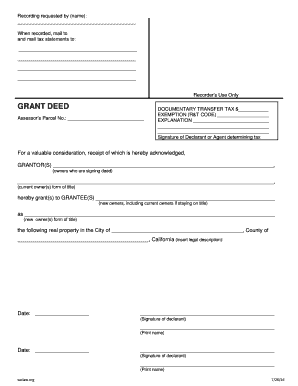

- Begin by entering the name of the individual or entity requesting the recording in the designated field at the top of the form. This represents the person or organization initiating the documentation.

- In the ‘When recorded, mail to’ section, provide the address where the recorded document and tax statements should be sent. Ensure the address is complete and accurate to avoid any delays.

- Locate the ‘Assessor’s Parcel No.’ field and input the specific parcel number associated with the property. This number is vital for identifying the property in tax records.

- Fill in the ‘Documentary Transfer Tax’ field by stating the amount applicable for the transaction. If you are claiming an exemption, enter the appropriate R&T Code in the ‘EXEMPTION (R&T CODE)’ section.

- Provide a brief explanation for the exemption in the corresponding section. Clearly articulate the reason for claiming this exemption to ensure proper processing.

- The next fields require signatures from the Grantor(s). Ensure all owners involved in the transaction sign the document, along with printing their names and including the date of signing.

- Finally, review all sections for accuracy and completeness. Once satisfied, you have the option to save changes, download, print, or share the completed form as needed.

Take action today and fill out your EXEMPTION (R&T CODE) form online to manage your tax responsibilities effectively.

Related links form

Exemption conditions owner or tenant of the property has their sole or main residence in a hospital or residential care home, nursing home or hostel in which they are receiving care or treatment. unoccupied dwelling was previously the sole or main residence of the absent person.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.