Loading

Get Images For What Need To Knowname Of The Bank:syndicatebank Loan Application Form Pradhan Mantri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Images For What Need To Know Name Of The Bank: SYNDICATEBANK LOAN APPLICATION FORM PRADHAN MANTRI online

This guide provides clear instructions on how to successfully complete the SYNDICATEBANK LOAN APPLICATION FORM PRADHAN MANTRI online. By following these steps, you will ensure that you provide all necessary information accurately and efficiently.

Follow the steps to effectively complete your loan application form.

- Press the 'Get Form' button to access the loan application form and open it in your preferred digital editor.

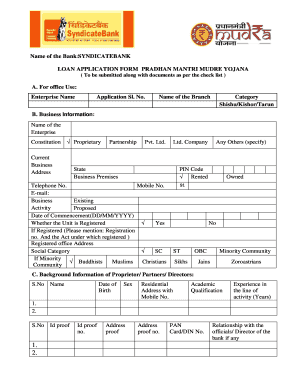

- Begin with section A, which is for office use. Fill in the enterprise name, application serial number, name of the branch, and select the category (Shishu, Kishor, or Tarun) applicable to your loan request.

- In section B, provide detailed business information such as the name of the enterprise, constitution type (e.g., proprietary, partnership, private limited, etc.), business address, pin code, and contact details (telephone, mobile, email). Indicate whether the business is registered and provide the registration number and act under which it is registered.

- For section C, fill in the background information of the proprietor, partners, or directors. Include names, dates of birth, gender, residential addresses with mobile numbers, academic qualifications, and years of experience in the activity.

- Completing section D involves providing information about associate concerns and their nature of association. List names, addresses, and the extent of interest you have in the associate concerns.

- In section E, detail any existing banking or credit facilities you currently have, including types of facilities, limits availed, and outstanding amounts. If you are banking with SYNDICATEBANK, include your customer ID here.

- In section F, outline the proposed credit facilities by specifying the type of facilities, amounts required, and the purpose for which they are needed.

- For working capital applications in section G, detail the basis of the cash credit limit applied, actual sales, projected inventory, and other financial data.

- In section H, provide specifics on term loan requirements, including details of machinery or equipment, total cost, and the contribution made by promoters.

- Section I requires submission of past performance and future estimates regarding net sales, net profit, and capital over specified years.

- In section J, confirm compliance with statutory obligations by selecting yes or no, and provide any necessary remarks regarding these obligations.

- Complete section K by certifying the accuracy of the information provided. Ensure to affix photos where indicated and provide signatures of relevant parties.

- Review the check list to ensure that all necessary documents are attached, such as identity proof, address proof, business documents, and any other required paperwork.

- Finally, after thoroughly reviewing the form for accuracy, you can save changes, download, print, or share the completed form as necessary.

Complete your loan application form online today for a smooth process.

Bills larger than $2 now have a water mark. $5 bills printed after 2008 will not have the president's image but a large numeral 5. This is important to determine if a lower denomination bill has been bleached and higher value currency printed on the paper.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.