Loading

Get Sc Uce-101-s 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the SC UCE-101-S online

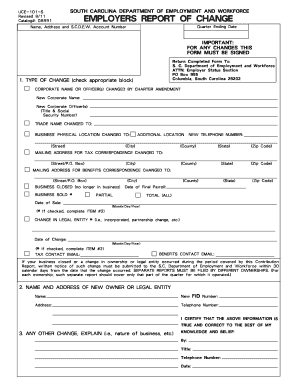

Filling out the SC UCE-101-S form online can help streamline the process of reporting changes related to your business. This guide provides step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to successfully complete the SC UCE-101-S form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering your business's name, address, and S.C.D.E.W. account number in the designated fields at the top of the form.

- Identify the type of change you are reporting by checking the appropriate box. Options include changes to corporate name, officer(s), trade name, business location, mailing addresses for tax or benefits correspondence, business closure, or ownership change.

- If your business has a new corporate name or officer(s), provide the details in the specified fields, including titles and social security numbers.

- For changes to the business's physical location, fill in the new address, including street, city, and state, as well as the new telephone number.

- If applicable, indicate the date of final payroll if the business has closed, or the date of sale if it has been sold. Provide the necessary details when prompted.

- If you checked the box for 'change in legal entity,' make sure to provide the date of change and a brief description of the nature of the change.

- In section two, provide the name, address, and telephone number of the new owner or legal entity if applicable. Include the FID number as well.

- If there are any other changes to report, explain them in the designated area.

- Finally, certify that the information provided is true by signing your name, entering your title, telephone number, and the date.

- Once you have completed all sections of the form, you can save your changes, download the form for your records, print it, or share it as necessary.

Take action now and complete your SC UCE-101-S form online for a smooth reporting process.

In South Carolina, unemployment tax rates can vary based on the employer's experience rating and other factors. Generally, rates range from 0.06% to 9.0% on the taxable wage base. Staying updated on changes in rates will help you budget effectively for your business’s SC UCE-101-S obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.