Loading

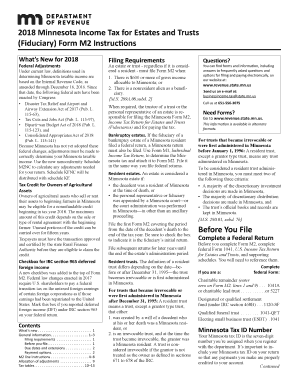

Get Minnesota Form M2 Instructions 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Minnesota Form M2 Instructions 2018 online

This guide provides clear instructions on how to effectively fill out the Minnesota Form M2 Instructions for 2018 online. It is designed to assist users, regardless of their prior legal experience, in completing the form accurately and efficiently.

Follow the steps to fill out the Minnesota Form M2 Instructions 2018 online.

- Click the ‘Get Form’ button to obtain the Minnesota Form M2 and open it in your chosen editor.

- Begin by entering the tax year at the top of the form, designating the relevant period for which you are filing.

- Input your Minnesota tax ID number. If you do not have one, you will need to apply for it through the appropriate channels.

- Check any applicable boxes at the top of the form to indicate the nature of your return (e.g., initial return, final return, etc.).

- Enter the gross income allocable to Minnesota as your starting point on the appropriate lines. Ensure that you distinguish between Minnesota source income and non-Minnesota income.

- Follow the instructions for deductions and adjustments by filling out lines regarding expenses and losses that are applicable according to Minnesota tax laws.

- Calculate the total tax owed based on the income reported, following the relevant tax tables included in the instructions.

- Complete any necessary schedules, such as the KF schedules, if you have beneficiaries or other factors that require additional reporting.

- Review all entered information for accuracy. Confirm that each section corresponds to the provided instructions.

- Once you have filled out the entire form, you can save your changes, download the document, or print it directly from your editor.

- Ensure to maintain a copy of the filled form and any additional schedules for your records, as well as sending the required documents to the Minnesota Department of Revenue.

Start completing your Minnesota Form M2 online now to ensure timely filing!

Is it OK to staple your tax return? The IRS accepts returns that are stapled or paperclipped together. However, any check or payment voucher, as well as accompanying Form 1040-V, must not be stapled or paperclipped with the rest of the return, since payments are processed separately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.