Loading

Get Pt-283t. Pt-283t

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PT-283T online

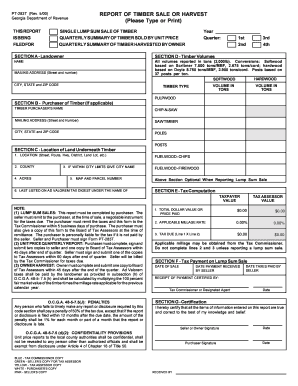

The PT-283T form is essential for reporting timber sales or harvest in Georgia. This guide will walk you through each section of the form, ensuring you complete it accurately and efficiently.

Follow the steps to complete the PT-283T form online.

- Press the ‘Get Form’ button to access the PT-283T document and open it in your editor.

- Specify the type of report you are filing by selecting one of the options: 'Single lump sum sale of timber', 'Quarterly summary of timber sold by unit price', or 'Quarterly summary of timber harvested by owner'. Fill in the appropriate year and quarter.

- In Section A, provide the landowner's name, mailing address, city, state, and ZIP code.

- In Section B, if applicable, enter the purchaser's name and mailing address, including city, state, and ZIP code.

- Proceed to Section C. Enter the location details of the land underneath the timber, including street address, county, city name (if applicable), map and parcel number, and acres.

- In Section D, indicate the timber volumes in tons for different timber types, such as hardwood, softwood, chip-n-saw, saw timber, poles, posts, fuelwood, and pulpwood. Use the conversion rates provided.

- Section E requires you to calculate tax values. Input the total dollar value or price paid, applicable millage rate, and tax due (calculated as line 1 multiplied by line 2) only if reporting a lump sum sale.

- In Section F, provide details regarding the tax payment on the lump sum sale, including the date of sale and date taxes were paid by the seller, if applicable.

- In Section G, certify the accuracy of the information provided by signing the form.

- Once all sections are completed, save your changes, download the document, print it, or share it as required.

Complete and submit your PT-283T form online today.

Ad Valorem Tax Assessment of Timber Sold In Georgia, timber is taxed only once during the period of its growth and that is at the time of harvest or sale. Timber is taxed at 100% of its fair market value and includes softwood and hardwood pulpwood, chip-and-saw logs, saw timber, poles, posts and fuel wood.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.