Loading

Get Memorandum Of Deposit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MEMORANDUM OF DEPOSIT online

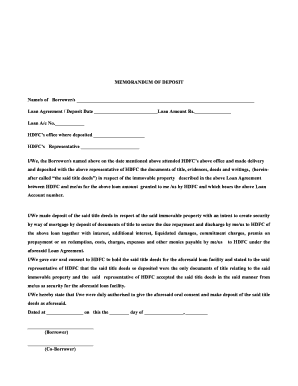

Filling out the Memorandum of Deposit online is a straightforward process that ensures your property documents are securely deposited as part of a loan agreement. This guide will provide you with step-by-step instructions to complete the form accurately.

Follow the steps to correctly fill out the MEMORANDUM OF DEPOSIT.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the names of the borrowers in the designated space. Make sure to include all individuals involved in the loan agreement.

- Fill in the loan agreement or deposit date. This should reflect the date on which the loan agreement was finalized.

- Input the loan amount in the specified field, ensuring that it accurately represents the sum granted by HDFC.

- Enter the loan account number associated with the loan. This number is critical for identifying your specific loan agreement.

- Specify the HDFC office where you deposited the documents. This helps in properly routing your documents.

- Provide the name of the HDFC representative with whom the documents were deposited. This information validates the transaction.

- In the space provided, write a statement indicating that you, the borrower(s), are depositing the title deeds as security for the loan. This section should express your intention clearly.

- Confirm your oral consent given to HDFC for holding the title deeds and that these are the only documents of title for the described immovable property.

- Fill in the date at the bottom of the document. This should correspond with the date of deposit.

- Finally, add your signature and the signature of any co-borrower, if applicable. Review the document for accuracy and completeness.

Complete your documents online with confidence and secure your property deposit today!

a written agreement between a person or company that borrows money and the bank lending the money in which the borrower promises to give the bank shares they own and have left with the bank, if they fail to pay back the loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.