Loading

Get Nc 5501

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC 5501 online

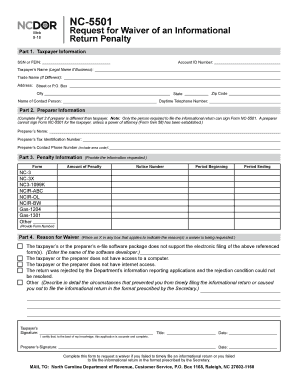

Filing Form NC 5501, Request for Waiver of an Informational Return Penalty, can be an essential step if you have missed deadlines for submitting informational returns. This guide provides clear instructions to help you successfully complete the form online.

Follow the steps to fill out the NC 5501 online effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- In Part 1, enter your taxpayer information. Include your Social Security Number (SSN) or Federal Employer Identification Number (FEIN), account ID number, legal name, trade name if different, address (street or P.O. Box, city, state, and zip code), name of the contact person, and their daytime telephone number.

- If the preparer is different from the taxpayer, complete Part 2. Provide the preparer's name, tax identification number, and contact phone number, including area code. Remember, the preparer cannot sign the form unless a power of attorney has been established.

- In Part 3, choose the form related to the penalty you are addressing by checking the appropriate box. Provide the amount of the penalty, notice number, period beginning, and period ending.

- In Part 4, indicate the reason for the waiver by checking the box that applies. You can select multiple reasons if applicable, such as lack of access to e-filing software or a computer. If you select 'Other,' provide a detailed description of your circumstances.

- Sign and date the form in the designated areas for both the taxpayer and, if applicable, the preparer. Ensure all information is accurate and complete.

- Once you have filled out the form, you can save your changes, download, print, or share the completed document as required.

Complete your NC 5501 form online today to ensure your waiver request is submitted promptly.

Is there a penalty for late filing of tax returns? Yes. If tax is due, both a failure to file penalty of 5% per month or fraction thereof with a maximum of 25% and a failure to pay penalty of 10% will be due. Interest is due on the amount of tax due from the date the tax was due until it is paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.