Loading

Get K 3e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the K 3e online

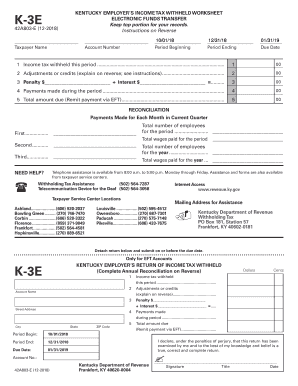

Filing the K 3e form is a crucial step for employers making payments of wages subject to Kentucky income tax. This guide provides clear and comprehensive instructions to help you complete the form accurately online.

Follow the steps to complete the K 3e form effectively.

- Click ‘Get Form’ button to obtain the K 3e document and open it in the online form editor.

- Fill in your taxpayer name and account number in the designated fields at the top of the form. Ensure this information is accurate to avoid any processing delays.

- Enter the period beginning and period ending dates. For example, if the taxable period is from October 1, 2018, to December 31, 2018, input these dates correctly.

- Specify the due date for the form submission, which for the example period is January 31, 2019. This ensures timely filing.

- Complete the income tax withheld for the period in the appropriate field. Double-check your figures to ensure accuracy.

- If applicable, detail any adjustments or credits on line 2, providing an explanation on the reverse side if necessary.

- Calculate any penalty and interest due if applicable, entering those amounts on line 3. Familiarize yourself with the penalties for late filing to avoid unnecessary fees.

- Document total payments made during the specified period in line 4. This keeps a clear record of your remitted amounts.

- In line 5, indicate the total amount due. If adjustments or credits were applied, ensure this figure reflects those corrections.

- Fill in the reconciliation section detailing monthly payments made in the current quarter, ensuring consistency with your records.

- Provide information on total employees and wages paid for both the current period and the entire year to comply with reporting requirements.

- Finally, review the entire document for accuracy before saving changes. You can then download, print, or share the completed form as required.

Complete your K 3e form online today to ensure timely and accurate filing.

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.