Loading

Get W 3n

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W-3N online

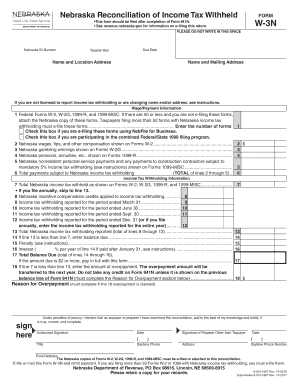

The W-3N form is essential for employers or payors in Nebraska who are required to report income tax withheld. This guide will provide you with a straightforward, step-by-step approach to complete the form efficiently online.

Follow the steps to accurately fill out the W-3N form

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering your Nebraska ID number and the taxable year for which you are filing. Be sure to include your name and physical address as well as your mailing address if it differs.

- Indicate the total number of federal Forms W-2, W-2G, 1099-R, and 1099-MISC that are applicable. If there are 50 or fewer forms and you are not e-filing, attach the Nebraska copies of these forms.

- For lines 2 through 5, enter the amounts of Nebraska wages, tips, gambling winnings, pensions, and other compensations as indicated on your federal forms. Ensure that the total amount is accurate and includes no duplications.

- In the income tax withholding information section, complete lines 7 through 12 with the appropriate amounts as reported on your federal forms. If applicable, enter any incentive compensation credits on line 8.

- Complete line 13 with the total income tax withholding reported and check for any balance due on line 14. If there is a balance due or any penalties, enter those amounts in lines 15 and 16 respectively.

- If line 7 is less than line 13, note the amount of overpayment on line 18 and provide a reason for the overpayment in the designated section.

- Finally, ensure the form is signed by the appropriate party, whether that be the taxpayer, partner, or preparer. Include the date and contact information.

- Review your entries for accuracy, save changes, and proceed to download or print the completed form, ready for submission online.

Complete your W-3N form online today for a hassle-free filing experience.

Related links form

Income tax. Social security tax. 401(k) contributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.