Loading

Get Schedule B 2

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule B 2 online

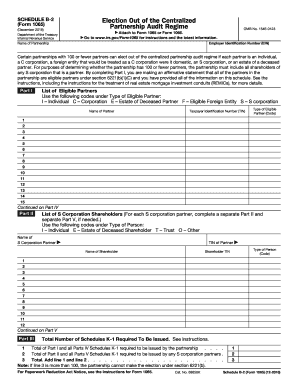

Filling out the Schedule B 2 is an important step for certain partnerships wishing to elect out of the centralized partnership audit regime. This guide will walk you through the online process step-by-step, ensuring you fill out the form accurately.

Follow the steps to complete Schedule B 2 efficiently.

- Press the ‘Get Form’ button to access the Schedule B 2 form and open it in your preferred editor.

- Begin by entering the name of the partnership in the designated field. Make sure this matches the official documents of the partnership.

- Next, input the Employer Identification Number (EIN) in the appropriate box. This number is vital for the identification of the partnership in the IRS records.

- Proceed to Part I, where you will list eligible partners. For each partner, provide the name, Taxpayer Identification Number (TIN), and select the type of eligible partner by using the appropriate code from the list provided.

- If your partnership includes S Corporation partners, you will need to complete Part II for each S Corporation partner, detailing the name, TIN, and specifying the type of person with the corresponding code.

- Continue to Part III. Here, calculate and enter the total number of Schedules K-1 required to be issued based on your entries in Parts I and II.

- If there are additional eligible partners, continue to Part IV to list them similarly as in Part I. Ensure all participants are accounted for.

- If there are additional S Corporation shareholders, complete Part V, repeating the process followed in Part II.

- Once you have filled out all the sections, review all entries to ensure accuracy and completeness. Errors could lead to complications with your submission.

- Finally, save the changes you've made to the form. You can then download, print for your records, or share the form as needed.

Start completing your Schedule B 2 online now to ensure compliance and timely submission.

Related links form

Schedule B is a tax schedule provided by the Internal Revenue Service (IRS) that helps taxpayers compute income tax due on interest paid from a bond and dividends earned. Individuals must complete this form and attach it to their annual tax returns if they received more than $1,500 in qualified interest or dividends.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.