Loading

Get Use Value Appraisal Program 3 Fmr-318 Forest

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Use Value Appraisal Program 3 FMR-318 FOREST online

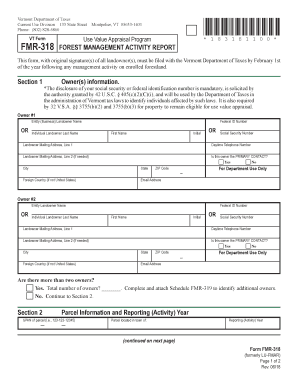

This guide provides comprehensive instructions for completing the Use Value Appraisal Program 3 FMR-318 FOREST online. Whether you are familiar with tax forms or new to the process, this step-by-step approach will help simplify your experience.

Follow the steps to successfully complete your form.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by filling out Section 1, which collects owner(s) information. Provide either the entity name or the individual's last name, first name, and initial, along with the federal identification number or social security number. Ensure to include a valid mailing address and daytime telephone number.

- If there is a second owner, fill out the same details for Owner #2. Repeat the process as needed if there are more owners, and attach Schedule FMR-319 for additional owners.

- In Section 2, provide the SPAN of the parcel and the town it is located in, along with the reporting year.

- Section 3 requires you to enter information for each stand. For each line, specify the stand number and the corresponding activities carried out.

- Complete the section for products harvested, including the volume for hardwood sawtimber, softwood sawtimber, firewood, pulp, and any other units harvested. You may also include comments regarding your activities.

- Section 4 entails collection of sap produced during sugaring activity. Enter the number of taps and optionally, the number of gallons of sap produced.

- Finally, in the signatures section, ensure that all owners sign and date the form. If an owner is signing on behalf of an entity, include the title.

- Once completed, save your changes. You may also choose to download, print, or share the form as necessary.

Complete your Use Value Appraisal Program 3 FMR-318 FOREST form online today!

The land use change tax is calculated as 10% of the fair market value of the developed parcel or portion of a parcel. When a portion of a parcel is withdrawn or developed, the fair market value of the portion is determined by valuing the portion as a stand-alone parcel.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.