Loading

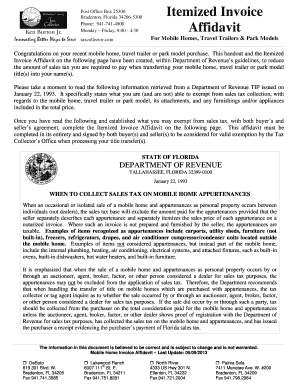

Get Mobile Home Itemized Invoice Affidavit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mobile Home Itemized Invoice Affidavit online

This guide provides clear and concise instructions on filling out the Mobile Home Itemized Invoice Affidavit online. By following these steps, users can ensure the accurate completion of the document, which is essential for reducing sales tax during the transfer of mobile homes, travel trailers, and park models.

Follow the steps to complete the affidavit accurately.

- Press the ‘Get Form’ button to obtain the Itemized Invoice Affidavit and open it in your preferred editor.

- Begin by entering the date of sale at the designated field.

- Input the Vehicle Identification Number (VIN) of the mobile home, travel trailer, or park model.

- Fill in the year, make, body type, and title number of the vehicle in the respective fields.

- In the section for purchasers, provide the printed names of all buyers along with their complete street address, city, state, and ZIP code.

- List the items included in the purchase price, specifying each item and its selling price separately. Ensure that furniture is itemized while utensils may be grouped together.

- Calculate the total of the listed item prices and enter it in the designated total field.

- Input the total purchase price in the respective field, followed by entering the itemized total previously calculated.

- Determine the taxable amount of the sale by subtracting the itemized total from the purchase price.

- The affidavit must be signed and dated by both the seller(s) and purchaser(s). Ensure all printed names are clearly stated.

- Review the document for accuracy, save changes, and then download, print, or share as necessary to complete the filing process.

Begin completing your Mobile Home Itemized Invoice Affidavit online today.

Transactions over $5,000 are subject to the state and discretionary sales surtax up to $5,000, each dollar over the $5,000 threshold is only taxed at the state rate of 6%. If you are curious to learn more information about Florida sales tax compliance, feel free to visit the Florida Dept.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.