Loading

Get Personal Property Declaration Form - Town Of Kennebunk

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Personal Property Declaration Form - Town Of Kennebunk online

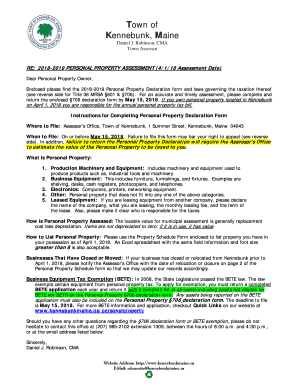

Completing the Personal Property Declaration Form for the Town of Kennebunk is an essential step for accurate property assessment and taxation. This guide will provide you with clear, step-by-step instructions to help you fill out the form online.

Follow the steps to complete the Personal Property Declaration Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your business information. Include your account number, business location, type of business, and business name. Ensure this information is accurate as it will be used for assessment.

- Provide your contact details including the owner's name, mailing address, email address, and contact numbers. You can opt to receive notifications by email by checking the designated box.

- If you are a new or first-time taxpayer, list all personal property owned as of April 1, including a detailed description and relevant specifics such as model or serial numbers. Use the provided format to ensure consistency.

- For previously assessed taxpayers, submit any changes to the property listing. Document any additions or deletions accurately and attach extra sheets if needed. If no changes occurred, simply state 'no changes' and sign the form.

- If applicable, fill in the section for leased equipment. Include details about the lessor, lease number, and any relevant financial information regarding the lease.

- Upon finishing all sections, review your entries for accuracy. Once confirmed, save the changes you’ve made to the form.

- You can then choose to download, print, or share the filled-out form as required. Ensure you submit it to the Assessor’s Office by the deadline.

Begin filling out your Personal Property Declaration Form online today to ensure accurate and timely assessment.

Overview of Maine Taxes Property tax rates in Maine are well above the U.S. average. The state's average effective property tax rate is 1.09%, while the national average is currently around 0.99%. The typical Maine resident will pay $2,756 a year in property taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.