Loading

Get B2g Cbsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the B2g Cbsa online

This guide provides a comprehensive overview of how to effectively complete the B2g Cbsa form online. With clear instructions tailored for users with varying levels of experience, you can navigate the application process smoothly.

Follow the steps to accurately complete the B2g Cbsa form.

- Press the ‘Get Form’ button to access and open the B2g Cbsa form in your online editor.

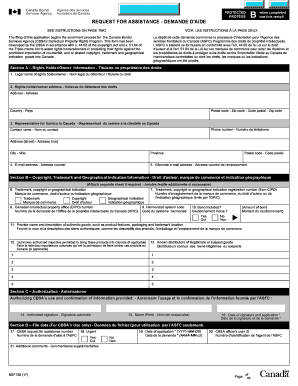

- In Section A, input the legal name of the rights holder or owner. Ensure that this name matches the official documentation to avoid discrepancies.

- Provide the rights holder/owner's mailing address, including the full address, country, and postal code.

- Enter the representative's information for service in Canada, including their name, contact number, and street address.

- Fill in the primary email address as well as an alternate email address for communications regarding the application.

- In Section B, indicate whether you are applying for trademark, copyright, or geographical indication protection. If applicable, attach a separate sheet with detailed descriptions.

- Submit the registration numbers for the trademark, copyright, or geographical indication as issued by the Canadian Intellectual Property Office.

- Provide the CIPO application number and the Harmonized System Code relevant to your application.

- Indicate if a bond is included in your application and specify the amount.

- Describe the authentic goods being protected, including their features, packaging, and trademark locations.

- List any known authorized importers permitted to bring these products into Canada.

- In Section C, provide your authorized signature, print your name, and complete the date fields.

- Finally, review your information carefully. You can then save changes, download, print, or share the completed form as necessary.

Complete the B2g Cbsa form online today for effective protection of your intellectual property rights.

26. The CBSA will strive to process casual refunds within 30-business days of receipt of the B2G package and all requisite supporting documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.