Loading

Get Ph Form R-7 1998-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH Form R-7 online

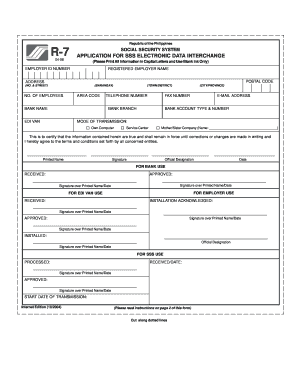

The PH Form R-7 is an important document for the application of electronic data interchange with the Social Security System in the Philippines. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the PH Form R-7 online.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin by filling out the fields related to your Employer ID Number and Registered Employer Name. Ensure that all entries are completed in capital letters and using only blank ink if you are printing the form.

- Continue by providing the postal code, address including street number, and barangay. Make sure to include the city or province to ensure your application is correctly processed.

- Input the number of employees currently registered with your company and the area code for your telephone number. This information is crucial for proper identification.

- Fill in the bank name and branch associated with your company, as well as the bank account type and number. Accurate banking information is necessary for the electronic data interchange.

- Select the mode of transmission that suits your needs: Own Computer, Service Center, or Mother/Sister Company. If applicable, write the name of the related company.

- Review the certification statement indicating that all information is true and the agreement to the terms and conditions. Ensure that the printed name, signature, official designation, and date are provided clearly.

- Once all sections are filled out, save your changes, and download the completed form. You may also print or share the form as necessary.

Complete your documents online with ease and accuracy.

Form 7R typically relates to applications or submissions under specific legal contexts. The details often vary by jurisdiction, but it generally serves to streamline processes for applicants. While exploring Form 7R, don’t forget to consider how the PH Form R-7 plays a role in related applications. uslegalforms can offer you tailored support and access to necessary forms, ensuring your paperwork is efficiently handled.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.