Loading

Get Canada T2 Short 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2 Short online

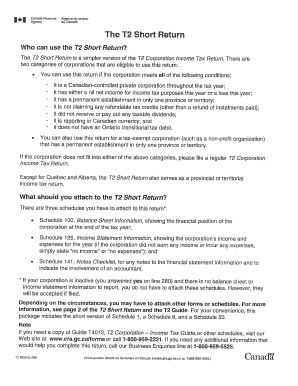

The Canada T2 Short is a vital document for corporate tax filing in Canada. This guide will help you navigate through the process of completing the form online with clear, step-by-step instructions.

Follow the steps to successfully complete the Canada T2 Short form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your corporation’s legal name and business number in the designated fields. Ensure that the information matches the records from Canada Revenue Agency.

- Complete the section for the fiscal period. Specify the start and end dates of your corporation's fiscal year, ensuring they are accurate.

- Fill in the income section. Report your total revenue and any deductions. Be careful to categorize your income accurately based on your business activities.

- Provide details related to taxes in the appropriate sections. This includes any applicable tax credits or payments that need to be claimed.

- Review the shareholder information section. List all shareholders, including their shares and contributions, ensuring accuracy to avoid discrepancies.

- Fill out the areas related to financial statements, if applicable. You may need to attach supporting documents to validate your financials.

- Finalize by reviewing all entered information carefully before submission. Ensure that all necessary fields have been completed and double-check for errors.

- Once all information is confirmed, save your changes. You can download, print, or share the completed form as needed.

Start completing your documents online today to ensure timely submission and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To report stock losses on your tax return in Canada, you must fill out Schedule 3 of the T1 return, detailing the loss incurred from the sale of stocks. It's crucial to keep thorough records of your transactions for accuracy. If you are uncertain, consulting with a tax professional can provide greater insight into this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.