Loading

Get Form Au-866

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form AU-866 online

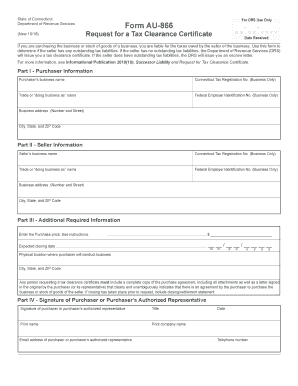

The Form AU-866, Request for a Tax Clearance Certificate, is essential for purchasers of a business to determine any outstanding tax liabilities of the seller. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring a smooth experience for all users.

Follow the steps to fill out the Form AU-866 effectively.

- Press the ‘Get Form’ button to access the Form AU-866 and open it in your chosen editor.

- In Part I, enter the purchaser’s business name, Connecticut Tax Registration Number if applicable, trade name or 'doing business as' name, Federal Employer Identification Number, and the complete business address including city, state, and ZIP Code.

- In Part II, provide the seller's business name, Connecticut Tax Registration Number, trade name or 'doing business as' name, Federal Employer Identification Number, and the complete business address including city, state, and ZIP Code.

- In Part III, carefully enter the full purchase price as required, using the guidelines provided. Specify the expected closing date in the given format, and the physical location where the purchaser will conduct business.

- Include a complete copy of the purchase agreement and a letter signed by the purchaser or their representative indicating the agreement to purchase the business or stock of goods.

- In Part IV, sign the form and print your name, company name, and email address of the purchaser or their authorized representative. Additionally, provide the date and telephone number.

- Once all fields are completed, review your entries for accuracy. Save your changes, then download and print the form, or share it as needed.

Complete and submit your Form AU-866 online to ensure a timely request for your tax clearance certificate.

The Failure to Pay Penalty will not exceed 25% of the total unpaid tax amount. The Failure to Pay Penalty is calculated the following way: The Failure to Pay Penalty is 0.5% of the unpaid taxes for each month or part of a month the tax balance remains unpaid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.