Loading

Get Canada Form 2 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada Form 2 online

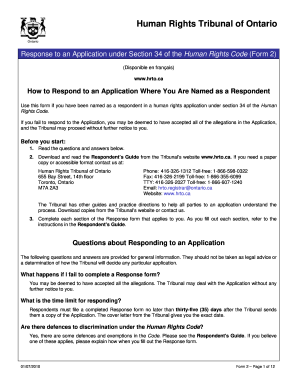

Canada Form 2 is used to respond to an application under Section 34 of the Human Rights Code. This guide will walk you through the essential steps for accurately completing the form online.

Follow the steps to fill out the Canada Form 2 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Complete the tribunal file number section at the top of the form. This number is provided in the cover letter you received from the Tribunal.

- Fill out the contact information for the respondent, including full name, organization type, title, and contact methods. Ensure all details are accurate to avoid delays.

- If applicable, complete the section for additional respondents or affected persons. Provide their full contact details as well.

- Address any requests for dismissal or deferment of the application based on the criteria outlined in the Respondent's Guide. Mark the appropriate box and include necessary documents.

- Respond to the allegations by summarizing facts and defenses that support your response. Clearly indicate which allegations you accept or contest.

- If applicable, detail any exemptions you believe apply to the application. Provide a rationale for these exemptions.

- Include any supporting documents that strengthen your response. Ensure that the document names and their relevance are listed.

- Review your completed response form for accuracy and completeness, ensuring that all required fields are filled.

- Sign the declaration at the end of the form, certifying that the information is complete and accurate. File your response by sending it to the appropriate address or by email.

Complete your Canada Form 2 online today to ensure timely processing of your response.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Canada T2 form is a comprehensive tax return specifically for corporations in Canada. It details all income, deductions, and taxes owed, helping businesses remain compliant with Canadian tax regulations. By filling out the T2 accurately, in conjunction with the Canada Form 2 when applicable, corporations can effectively manage their fiscal responsibilities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.