Loading

Get Canada 1755 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada 1755 online

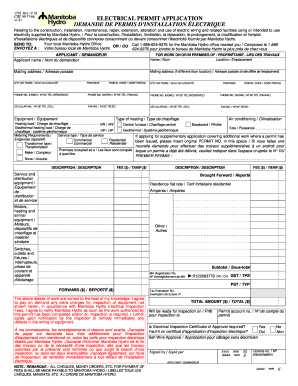

The Canada 1755 form is essential for applying for electrical permits in Manitoba, Canada. This guide provides clear, step-by-step instructions on how to fill out the form online, ensuring users can navigate the process effectively and efficiently.

Follow the steps to successfully complete your Canada 1755 application.

- Click the ‘Get Form’ button to access the Canada 1755 form and open it in the online editing tool.

- Begin by filling out the applicant section. Enter your full name as the applicant and ensure all contact information is accurate.

- In the 'For work on or in premises of' section, input the name of the property owner and provide the location where the work will be done.

- Complete the mailing address fields. If the mailing address differs from the location, provide the correct address as necessary.

- Fill in the phone number fields. This should include home and work telephone numbers, as well as a cellular number for contact.

- Describe the equipment you intend to install. Specify the type of heating and air conditioning alongside the heating load in kW.

- Indicate the service type and your metering requirements. If this is a supplementary application, include the original permit number.

- Provide a clear description of the work to be performed along with the estimated fees associated with the project.

- Affirm that the information provided is correct. Sign and date the document where indicated.

- Finally, save your changes. You can download, print, or share the completed form as needed.

Complete your Canada 1755 application online today!

A lump sum payment in Canada can be subject to different tax treatments, depending on the source of the income. Generally, it is taxed in the year you receive it, and the amount may influence your overall tax bracket. Understanding the implications and potential strategies can help you manage the tax burden effectively. For more detailed assistance, Canada 1755 offers resources that clarify these taxation rules.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.