Loading

Get Annuity Partial Withdrawal Or Surrender Request - Ameritas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Annuity Partial Withdrawal Or Surrender Request - Ameritas online

Filling out the Annuity Partial Withdrawal Or Surrender Request - Ameritas online is a straightforward process that allows users to manage their annuity withdrawals or surrenders efficiently. This guide provides step-by-step instructions to help users complete the form accurately and confidently.

Follow the steps to successfully complete your withdrawal or surrender request.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

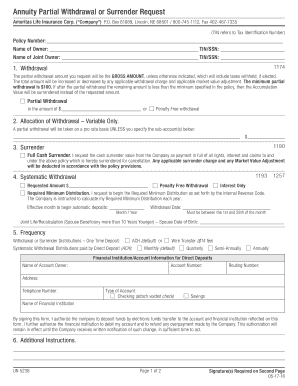

- Enter your policy number, the name of the owner, and their corresponding Tax Identification Number (TIN) or Social Security Number (SSN) in the designated fields.

- If applicable, provide the name of the joint owner along with their TIN/SSN as required.

- Indicate the amount you wish to withdraw in the 'Withdrawal' section. Specify if it is a penalty-free withdrawal and ensure it meets the minimum requirement of $100.

- For variable accounts, indicate the allocation of your withdrawal. You can choose to take a pro-rata basis or specify the sub-accounts and amounts directly.

- In the 'Surrender' section, you can request the full cash surrender value of your policy, acknowledging that any applicable charges will be deducted.

- If selecting systematic withdrawal, specify the amount, the effective month for automatic deposits, and the desired withdrawal date.

- Complete the frequency of withdrawals by selecting your preferred option such as one-time, monthly, quarterly, semi-annually, or annually.

- Fill out financial institution and account information for direct deposits, including the name of the account owner, account number, routing number, and type of account.

- Review the section on tax withholding, where you can decide if you want federal income tax withheld and any additional percentage, if desired.

- Sign and date the form as required, ensuring you include the necessary signatures for joint owners or other required individuals where applicable.

- Once all fields are complete, save your changes, and you can download, print, or share the form as needed.

Complete your Annuity Partial Withdrawal Or Surrender Request - Ameritas online today to manage your financial needs.

How long does it take to cash out an annuity? If your annuity funds a structured settlement, the cash-out and court approval process may take 45 to 90 days. For all other annuities, the withdrawal process can span roughly four weeks, depending on the quickness of the insurance company and buyer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.