Loading

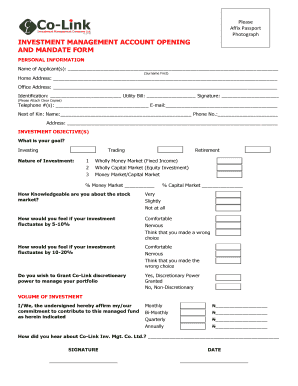

Get Investment Management Account Opening And Mandate Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Investment Management Account Opening And Mandate Form online

This guide provides a step-by-step process for completing the Investment Management Account Opening And Mandate Form online. Follow these instructions to ensure you fill out the form accurately and efficiently.

Follow the steps to successfully complete the form:

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Start with the personal information section. Fill in your name, ensuring the surname is written first. Provide your home and office address.

- In the identification section, enter your identification number and attach a clear copy along with a recent utility bill. Make sure to sign where indicated.

- Complete the telephone and email fields with your contact information. Include the name and phone number of your next of kin, along with their address.

- Move to the investment objectives section. Select your goals by checking the appropriate box for investing or trading. Choose the nature of your investment by marking one of the options provided.

- Indicate your knowledge level regarding the stock market by selecting very knowledgeable, slightly knowledgeable, or not at all.

- Reflect on your feelings about investment fluctuations. Choose options that best describe your reaction if your investment fluctuates by 5-10% and 10-20%.

- Decide whether to grant discretionary power to Co-Link by selecting yes or no.

- Next, affirm your commitment to invest by filling in the investment volume, specifying the amounts for monthly, bi-monthly, quarterly, and annual contributions.

- Finally, state how you learned about Co-Link Investment Management Co. Ltd., and sign the form along with the date to finalize your application.

Complete your documents online today to start your investment journey!

The mandate of a collective investment vehicle is a statement of its aims, the limits within which it is supposed to invest, and the investment policy it should follow. A fund (or portfolio) will typically define: the aim of the fund (e.g., to generate dividend income or long term growth)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.