Get Au Su004 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU SU004 online

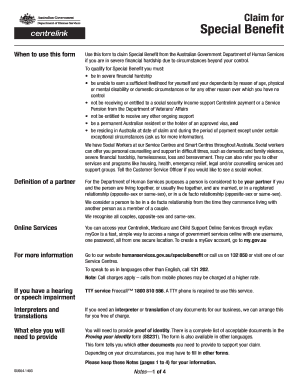

The AU SU004 form is used to claim Special Benefit from the Australian Government Department of Human Services for individuals experiencing severe financial hardship. This guide offers clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the AU SU004 form online.

- Click the ‘Get Form’ button to obtain the AU SU004 form and open it for editing.

- Begin by providing your personal details in the relevant sections. Ensure you include your full name, date of birth, and contact information. Be careful to follow the instructions regarding the format, such as using BLOCK LETTERS and a black or blue pen if applicable.

- Describe the reasons for your claim thoroughly in the designated section. Detail any circumstances that have led to your financial hardship, ensuring you include any recent changes that may apply.

- Answer all questions regarding your financial situation, including previous names, current living arrangements, and relationship status. Ensure that you mark the boxes clearly.

- Provide information on your residency status, including your citizenship or visa details. Be honest, as this information is crucial for processing your claim.

- Fill out any additional sections related to your dependents or children, if applicable. Include all required information about their circumstances.

- Review your form carefully. Make sure all fields are completed accurately and that you have signed and dated the form at the end.

- Submit the completed form and any additional required documents via the available submission methods. If filing online, ensure you have registered for Online Services to facilitate this process.

- After submission, keep a copy of your completed form and any documents you’ve submitted for your records. It's advisable to save a digital copy if you completed the form online.

- Return this form and all required documents within 14 days to ensure prompt processing of your claim. If you cannot return your documents within this timeframe, contact the Department for guidance.

Complete your AU SU004 form online today to facilitate your claim for Special Benefit.

Get form

The estimated total income in Form 15H refers to the income you expect to earn during the financial year, which influences your eligibility for tax exemption. Typically, this includes pension, rental income, or any other income you plan to receive. Providing an accurate estimate is critical to avoid complications with tax authorities. For further assistance, AU SU004 can provide tools and guidance to accurately complete your forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.