Get Va Irrrl Comparison 2004-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA IRRRL Comparison online

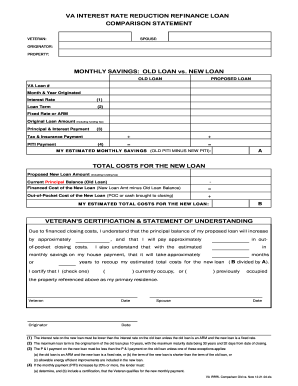

The VA Interest Rate Reduction Refinance Loan (IRRRL) Comparison is a valuable tool designed to help users evaluate their refinancing options. This guide will provide clear and effective instructions on how to fill out the form online, ensuring a smooth and accurate completion process.

Follow the steps to fill out the VA IRRRL Comparison online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill in the veteran's information in the designated section, including their name and related details.

- Complete the spouse's information if applicable, by entering their name in the corresponding field.

- Enter the originator's information, which typically includes the lender's name and relevant contact details.

- Provide property details, including the address and any specific identifiers associated with the home.

- In the monthly savings section, input the details of the old loan including VA loan number, month & year originated, and the interest rate.

- Indicate the loan term, the type of interest rate (fixed or adjustable), the original loan amount (including the funding fee), and both the principal & interest payment and PITI payment.

- Calculate and enter the tax and insurance payment to derive the total monthly cost of the old loan.

- Repeat the same entry process for the proposed new loan, capturing all relevant financial elements.

- List the estimated monthly savings calculated by subtracting new PITI payment from old PITI payment.

- Complete the total costs for the new loan section, accurately providing numbers for the proposed new loan amount and current principal balance.

- Calculate out-of-pocket costs for the new loan and document the estimated total costs.

- In the certification and statement of understanding section, ensure the veteran reviews and acknowledges the terms regarding additional costs.

- Obtain the necessary signatures and dates from the veteran, spouse, and originator to finalize the document.

Complete your VA IRRRL Comparison online to streamline your refinancing process.

The VA IRRRL program can be a valuable option for those eligible veterans looking to save on their mortgage payments. By participating in this program, you can lower your interest rate without extensive documentation, making the refinancing process smoother. When you conduct a VA IRRRL Comparison, you'll notice potential savings that can significantly impact your financial situation. UsLegalForms offers resources and guidance to help you navigate this program effortlessly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.