Loading

Get Oregon 2018 Asc Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Oregon 2018 Asc Instructions online

Filling out the Oregon 2018 Asc Instructions online is a straightforward process that can be managed efficiently with careful attention to each section. This guide provides step-by-step instructions to assist you in completing the form accurately, ensuring you meet all necessary requirements.

Follow the steps to complete your Oregon 2018 Asc Instructions online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

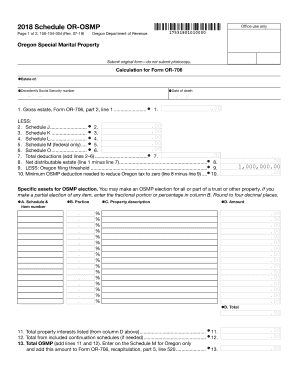

- Begin by entering the estate details, including the decedent's name, social security number, and date of death. Ensure accuracy in the information provided as this serves as the foundation of the entire submission.

- Fill in the gross estate amount on line 1 using information from Form OR-706, part 2, line 1.

- Complete lines 2 through 6 by entering totals from corresponding federal schedules. Specifically, include funeral and administrative expenses, debts, net losses during administration, marital bequests, and charitable bequests.

- Calculate total deductions (line 7) by adding lines 2 to 6, and then derive net distributable estate on line 8 (line 1 minus line 7).

- On line 9, indicate the Oregon estate transfer tax filing threshold, which is $1 million.

- Determine the minimum OSMP deduction on line 10 (line 8 minus line 9) necessary to reduce the Oregon tax liability to zero.

- Document specific assets for the OSMP election. Enter the schedule and item number, and provide a description for each property under columns A, B, and C. Ensure to round any fractional portions or percentages in column B to four decimal places.

- Total the property interests listed and calculate the OSMP election amount for inclusion on Oregon-only Schedule M and to add to Form OR-706.

- Finally, save your changes, and choose to download, print, or share the completed form as needed.

Complete your Oregon 2018 Asc Instructions online to ensure a smooth filing process.

Withholding Formula (Effective Pay Period 03, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $7,500$219.00 plus 4.75%Over $7,500 but not over $18,900$575.00 plus 6.75% of excess over $7,500Over $18,900$1,345.00 plus 8.75% of excess over $18,900 Mar 8, 2022

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.