Loading

Get Rp425ivp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rp425ivp online

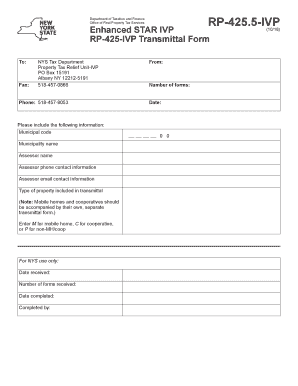

The Rp425ivp is an important transmittal form used for submitting information related to the Enhanced STAR program. This guide will provide you with clear and step-by-step instructions on how to fill out this form online.

Follow the steps to complete the Rp425ivp form efficiently.

- Click the ‘Get Form’ button to download the rp425ivp document and open it in the online editor.

- Begin by entering the municipal code in the designated field. This code should be obtained from your local municipality's resources.

- Next, input the name of the municipality accurately. Ensure that you double-check spelling for clarity.

- Provide the assessor's name in the appropriate space. This identifies the individual responsible for property assessments in your municipality.

- Fill in the assessor's phone contact information. It is important that this information is valid and up-to-date for correspondence.

- Enter the assessor's email contact information in the designated area. This allows for quick communication if needed.

- Indicate the type of property included in the transmittal by entering 'M' for mobile home, 'C' for cooperative, or 'P' for non-mobile home/cooperative properties.

- If your submission includes mobile homes or cooperatives, remember to attach their respective transmittal forms separately as noted in the instructions.

- Review all entered information for accuracy and completeness before final submission.

- Once completed, you can save changes, download, print, or share the form as required.

Start filling out your Rp425ivp form online today to ensure you are ready for submission.

To be eligible, property owners must be 65 years of age or older with incomes that do not exceed $60,000 a year. For property owned by a husband and wife, only one of them has to be at least 65 years of age. Their combined annual income, however, must not exceed $60,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.