Loading

Get Pension Drawdown Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pension Drawdown Form online

This guide will assist you in seamlessly completing the Pension Drawdown Form online. The process is straightforward and aims to help you manage your pension drawdown effectively and efficiently.

Follow the steps to complete your Pension Drawdown Form online:

- Press the ‘Get Form’ button to download the Pension Drawdown Form and open it in your preferred editor.

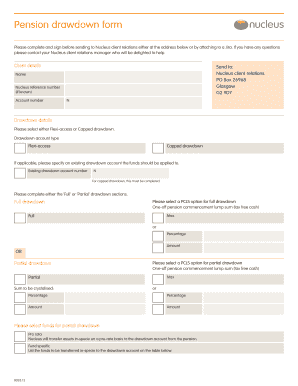

- Begin filling out the client details section. Provide your full name, Nucleus reference number (if known), and account number.

- In the drawdown details section, select either 'Flexi-access' or 'Capped drawdown' based on your preference.

- If you are completing a capped drawdown, ensure you specify your existing drawdown account number.

- Decide whether you want a Full or Partial drawdown and complete the corresponding sections.

- For a Full drawdown, choose a PCLS option: 'One-off pension commencement lump sum' and specify the amount or percentage.

- For a Partial drawdown, select the PCLS option like before, providing either a specific amount or percentage for the funds to be crystallized.

- Identify the specific funds for partial drawdown by listing them in the appropriate table, providing the asset names and percentages.

- In the income payment details section, select your taxable income payment options, frequency, and the amount.

- For capped drawdown accounts, indicate the first payment date in the dd/mm/yyyy format.

- In the fees section, indicate any initial and annual advice fees to be deducted from your drawdown account.

- Review the authorisation section. Read each declaration carefully and sign to confirm your understanding.

- Finalize your application by saving the changes. You can then download, print, or share the completed form as needed.

Complete your Pension Drawdown Form online today!

How much should I drawdown from my pension? Experts recommend sticking to the safe withdrawal rate. It's recommended that you don't take more than 4% of your pension pot in 1 year. In theory, this leaves enough of your pension invested that the growth of your investment over time should cover any withdrawals you make.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.