Loading

Get Form 13

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 13 online

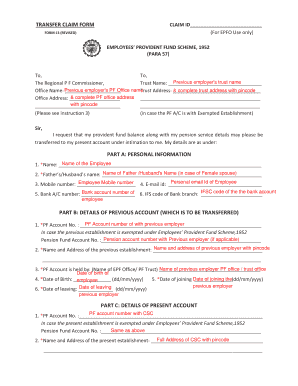

Filling out Form 13 online is an essential step for individuals looking to transfer their provident fund balance and pension details from a previous employer to their current account. This guide provides clear and supportive instructions to ensure you complete the form accurately and efficiently, even if you have little experience with legal documents.

Follow the steps to successfully complete Form 13 online:

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- In Part A, enter your personal information. Provide your full name, your father's or partner's name (if applicable), your email address, and your mobile number.

- Next, fill in your banking details. Enter your bank account number and the IFSC code of your bank branch in the designated fields.

- Proceed to Part B to detail your previous account information. Enter your PF account number and pension account number (if applicable), along with the name and address of your previous employer.

- Complete the mandatory fields regarding your date of birth, date of joining, and date of leaving your previous employer.

- In Part C, enter your current PF account number and the full address of your present establishment, ensuring to include the pin code.

- Fill in your date of joining at the current establishment and, if your current employer is exempt under the EPF Scheme, provide the name of the trust and your employee code.

- Review the information you have provided carefully to ensure accuracy. Once verified, you can sign the form in the designated area.

- Finally, save your changes and you can choose to download, print, or share the completed form as required.

Complete your Form 13 online today for a smooth transfer process.

Considering tendency of taxpayers to adopt tax evasion measures, Income tax provisions provide for deduction of tax at source / collection of tax source. Tax rates for such deduction are provided under Section 192, Section 194 and 195(non-residents).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.