Loading

Get Sme First Account

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SME First Account online

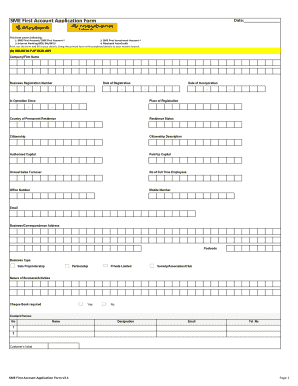

Filling out the SME First Account Application Form online can be a straightforward process with the right guidance. This comprehensive guide will help you navigate through each section of the form, ensuring you provide all necessary information accurately.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the business particulars section. Enter your company or firm name, business registration number, date of registration, and other related details accurately.

- Fill in the personal particulars if you are applying as a sole proprietor. Provide information such as your name, gender, birth date, and occupation.

- In the banking account section, select the type of account you wish to open (e.g., SME First Account, SME First Investment Account-i) and fill in details for partners or directors if applicable.

- Complete the internet banking application. Provide necessary user details and select the appropriate user access types for each appointed user.

- If applicable, provide details related to Maybank AutoCredit, including payment software and total payment amounts.

- Fill in the FATCA/CRS entity or individual self-certification form and complete all relevant sections that apply to your account type.

- Review the requirements for account opening carefully. Ensure you have all necessary documents prepared as specified in the form.

- Sign the declaration section, confirming that all provided information is true and accurate, and agree to the stipulated terms.

- Once you have filled out all sections, save your changes, and be sure to download or print the form for your records.

Complete your SME First Account application online today.

SME First Account-i. A Shariah compliant current account based on the contract of Commodity Murabahah (cost-plus-sale) where a specific asset as deemed fit by the Bank is identified and used as the underlying asset for the sale and purchase transaction between Bank and Customer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.