Loading

Get Ftb 1150

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FTB 1150 online

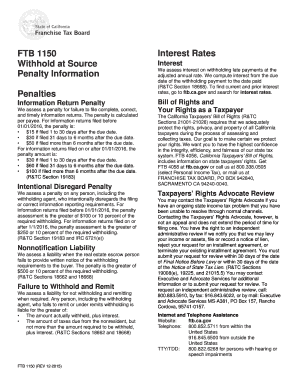

Filling out the FTB 1150 form online is an essential process for reporting withholding information to the California Franchise Tax Board. This guide provides a clear, step-by-step approach to help users accurately complete the form, ensuring compliance with tax regulations.

Follow the steps to fill out the FTB 1150 with ease.

- Click ‘Get Form’ button to access the FTB 1150 form and open it in your browser.

- Begin by entering your personal or business information in the designated fields, ensuring that all details are accurate and up to date.

- Provide the relevant withholding details in the appropriate sections, including the amounts withheld and the recipients of those amounts.

- Review the section on penalties thoroughly. Understand the penalties associated with late or incorrect submissions, as this will help you avoid potential liabilities.

- Make sure to read through the Taxpayers' Bill of Rights section, which outlines your rights as a taxpayer. Familiarity with this information is crucial for compliant filing.

- Once you have filled out all sections of the form, carefully review all entries for accuracy to ensure that your submission is complete.

- Finally, save your changes, download a copy for your records, and you may choose to print or share the form as needed. Ensure that you keep a copy of your submission for future reference.

Complete your FTB 1150 online today to ensure your tax compliance and avoid potential penalties.

Yes. Payments that are received after the due date are subject to interest and/or penalties. A penalty of ten percent (six percent for prepayments) of the tax is imposed on amounts received after the due date. Interest is also due for each month or fraction of a month the tax payment is late.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.