Loading

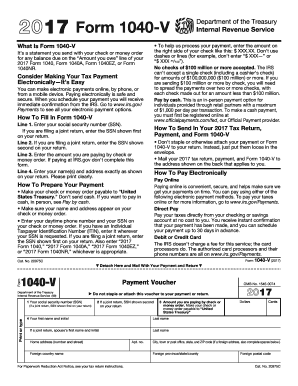

Get 2017 Form 1040-v. Payment Voucher

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2017 Form 1040-V. Payment Voucher online

Filling out the 2017 Form 1040-V, the payment voucher, is an essential step for ensuring your tax payments are processed correctly. This guide provides detailed steps for completing the form online, ensuring clarity and ease throughout the process.

Follow the steps to fill out your Form 1040-V correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- On Line 1, enter your social security number (SSN). For joint returns, input the SSN for the primary filer as indicated on your return.

- On Line 2, if filing jointly, enter the SSN for the secondary filer.

- Line 3 requires you to enter the total amount you are paying via check or money order. If you are using electronic payment, you do not need to complete this form.

- On Line 4, provide your name(s) and address exactly as they appear on your tax return. Be sure to print clearly.

- Prepare your payment by making your check or money order payable to 'United States Treasury.' Ensure your name and address are printed on the payment.

- Include your daytime phone number and SSN on your check or money order. If applicable, use your Individual Taxpayer Identification Number (ITIN) instead of your SSN.

- Do not staple or attach your Form 1040-V to your tax return and payment; place them in the envelope loose.

- Mail your completed 2017 tax return, payment, and Form 1040-V to the appropriate address as indicated on the back of the form based on your location.

- After completing the form, save changes, download, print, or share it as needed.

Complete your payment voucher online today to ensure a smooth submission process.

You can use direct pay to make a payment from your checking or savings account without paying any additional fees. You will receive instant confirmation that your payment is made, and you can schedule your payment up to 30 days in advance. You can also use your debit or credit card to pay your tax bill.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.