Loading

Get Form 17 Articles Of Dissolution

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 17 Articles Of Dissolution online

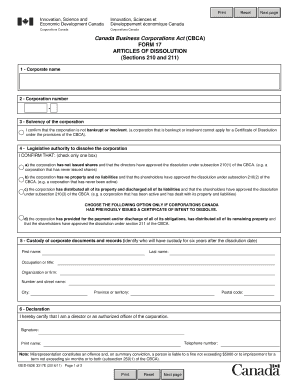

Filling out the Form 17 Articles of Dissolution is a crucial step for any corporation looking to formally dissolve their business. This guide provides a clear, step-by-step approach to help users navigate the online process with ease and confidence.

Follow the steps to complete the form successfully.

- Click the ‘Get Form’ button to access the Form 17 Articles of Dissolution. This will allow you to open the form in an online editor where you can begin the completion process.

- In the first field, enter the corporate name exactly as it is registered. This must match the name in your official documentation.

- Next, input the corporation number, which is the unique identifier assigned to your corporation by the registering authority.

- Confirm the solvency of the corporation by checking the box indicating whether the corporation is bankrupt or insolvent. Remember, a corporation that is bankrupt or insolvent cannot apply for a certificate of dissolution.

- In this section, indicate the legislative authority for dissolution. Choose only one option that applies to your corporation's situation based on the subsections of the Canada Business Corporations Act.

- Designate the custody of corporate documents and records. Fill in the first name, last name, occupation or title, organization or firm, and the full address of the individual who will keep these records for six years post-dissolution.

- Complete the declaration at the end of the document. This section must be signed by a director or an authorized officer, along with their telephone number and printed name.

- After ensuring all information is accurate and complete, you can save the changes. You have the options to download, print, or share the Form 17 Articles of Dissolution as needed.

Complete your dissolution documents online today to ensure a smooth and efficient process.

Steps to dissolve, surrender, or cancel a California business entity File all delinquent tax returns and pay all tax balances, including any penalties, fees, and interest. File the final/current year tax return. ... Cease doing or transacting business in California after the final taxable year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.