Loading

Get Quarterly Return Adjustment Form (de938sef)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Quarterly Return Adjustment Form (DE938SEF) online

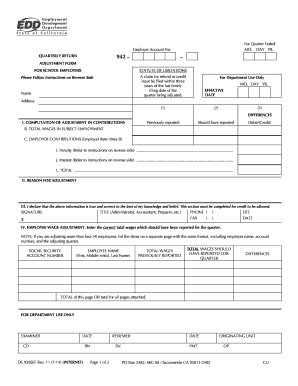

The Quarterly Return Adjustment Form (DE938SEF) is essential for adjusting prior quarter contributions for school employers. This guide will walk you through the process of completing this form online to ensure accurate adjustments.

Follow the steps to successfully complete the form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the date for the quarter being adjusted in the format MO. DAY YR. This date should reflect the end of the quarter that you're making adjustments for, such as 03/31/2023 for the first quarter.

- Fill in your employer account number in the allocated section. Ensure that this number is accurate to avoid processing delays.

- Provide your name and address in the designated fields. Double-check the accuracy of your contact details.

- In Item I, define the computation of adjustment in contributions. For each line, enter the previously reported amounts in Column 1, the amounts that should have been reported in Column 2, and calculate the differences in Column 3.

- On line I, include any applicable penalty. The standard penalty is 15% of the contributions shown on Line C, or 10% for periods before the third quarter of 2014.

- For line J, calculate any interest due on the total unpaid contributions plus penalty. Ensure that you follow the prescribed rate and method.

- Calculate the total amount due on Line L by adding the total contributions, penalty, and interest. If there's a balance due, ensure you prepare a check for this amount.

- In Item II, briefly explain the reason for the adjustment made in Item I. Clear explanations help in processing the form smoothly.

- In Item III, ensure to sign the form. Include your title, phone number, extension, and the date of signing. This step is crucial for validating your claim.

- If you need to adjust employee wages, complete Item IV with the correct data for each employee. If there are adjustments for more than four employees, list them on a separate page using the same format.

- Once you have completed the form, ensure to save your changes. You can download, print, or share the form as needed.

Complete your Quarterly Return Adjustment Form (DE938SEF) online to ensure accurate filings and avoid penalties.

The Quarterly Contribution and Wage Adjustment Form (DE 9ADJ) is used to request corrections to information previously reported on a Quarterly Contribution Return and Report of Wages (DE 9) and/or Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.