Loading

Get 8038 G

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8038 G online

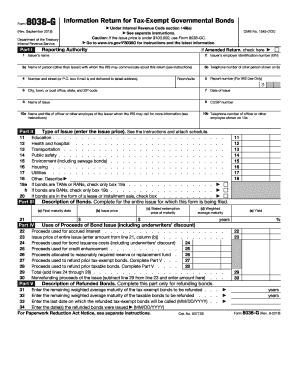

The 8038 G is an essential form for tax-exempt governmental bonds under the Internal Revenue Code. This guide will provide you with step-by-step instructions to effectively complete the 8038 G online.

Follow the steps to complete the 8038 G form seamlessly.

- Click ‘Get Form’ button to acquire the form and open it in your preferred editor.

- Begin by entering the reporting authority and check the box if this is an amended return. Fill in the issuer’s name and employer identification number (EIN).

- Provide the name and contact number of a designated person for IRS communication. Include the street address and postal code.

- Document the date of the bond issue and the name of the issue, along with the CUSIP number for identification.

- In Part II, select the type of issue and input the issue price. Complete all required fields regarding various financing types.

- Detail the use of proceeds from the bond issue, ensuring to complete all related subsections accurately.

- Complete Part V if you are refunding bonds, entering relevant details about the maturity of existing bonds.

- In Part VI, provide information regarding miscellaneous details, including any state volume cap and investment contracts.

- Sign and date the form, ensuring that all information is accurate and complete. If applicable, include details for paid preparers.

- Once completed, you can save changes, download, print, or share the form as necessary.

Start completing your 8038 G form online today for efficient processing.

Form 8038 is used by the issuers of tax-exempt private activity bonds to provide the IRS with the information required by section 149 and to monitor compliance with the requirements of sections 141 through 150.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.