Loading

Get Firpta Certification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FIRPTA Certification online

The FIRPTA Certification is a crucial document for buyers involved in real estate transactions where the seller may be a foreign person. This guide will walk you through the online process of filling out this certification, ensuring you understand each section and its requirements.

Follow the steps to complete the FIRPTA Certification effectively

- Click ‘Get Form’ button to access the FIRPTA Certification and open it in the designated editor.

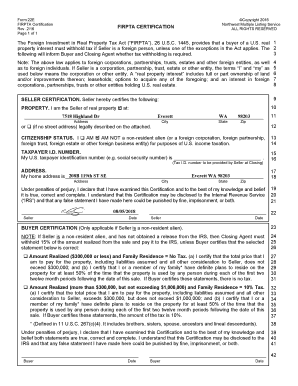

- At the top of the form, you will find a section titled 'Seller Certification.' Here, start by confirming that you are the seller of the property by selecting the first option.

- Next, provide the full address of the property you are selling, including the street address, city, state, and zip code.

- In the 'Citizenship Status' section, select the appropriate option to certify your status regarding U.S. taxation. Indicate whether you are or are not a non-resident alien or foreign entity.

- You will need to input your U.S. taxpayer identification number in the designated field, which is typically your social security number.

- Enter your personal home address in the specified section, ensuring all fields such as address, city, state, and zip code are filled out.

- Review your entries thoroughly. Next, you will need to sign and date the certification at the bottom of the form to affirm that all information is correct to the best of your knowledge.

- If applicable, navigate to the 'Buyer Certification' section if the seller is a non-resident alien. Complete the necessary certifications regarding the amount realized from the sale.

- After ensuring all fields are accurately filled out, you may save changes, download, print, or share the FIRPTA Certification as needed.

Complete your FIRPTA Certification online today to ensure compliance and smooth transaction processing.

FIRPTA Certificate: A FIRPTA certificate is used to to notify the IRS that the seller of real estate is not a foreign-person. When a foreign person sells real estate, the IRS wants to know about it. Even though some capital gains income tax is exempt to foreign persons, real estate is not exempt.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.