Loading

Get Form Gst Rfd-05 In Word And Pdf. Gst Forms ... - Taxreply

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form GST RFD-05 in Word and PDF

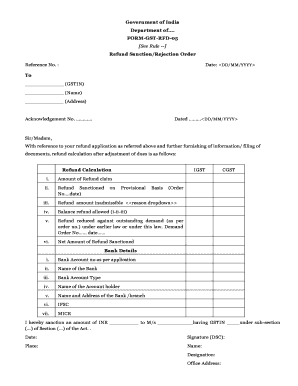

Form GST RFD-05 is essential for individuals seeking a refund of Goods and Services Tax. This guide offers a clear, step-by-step approach to completing the form, ensuring users of all experience levels can navigate the process confidently.

Follow the steps to complete Form GST RFD-05 successfully.

- Click the ‘Get Form’ button to access the form and open it using your preferred document editor.

- Enter the reference number and date at the top of the form. Ensure that the format is consistent with the specified DD/MM/YYYY style.

- Provide the GSTIN, name, and address of the applicant. Ensure all details are accurate to avoid processing delays.

- Fill in the acknowledgment number and date, which reflects the receipt of your refund application.

- Complete the refund calculation section. Input the amount claimed, the sanctioned refund number and date, and any inadmissible refund reasons from the dropdown.

- Calculate and input the balance refund allowed, including deductions for any outstanding demand as per the relevant order numbers.

- In the bank details section, provide all necessary information including bank account number, name of the bank, account type, account holder's name, bank branch address, IFSC, and MICR.

- Finalize by stating the total sanctioned refund amount in words and confirming the legal basis for the sanction.

- Add the date, and sign as required. Ensure that all fields are correctly filled to avoid any issues with your refund.

- Once completed, save your changes, and download or print the form for your records. You can also share the form as needed.

Start filling out your GST RFD-05 form online to streamline your refund process.

RFD-01 is an application for the online processing of refunds under GST. It is to be e-filed on the GST portal to claim the refund of: Taxes, cess and interest paid in case of zero-rated supplies (except the export of goods with tax payment). Balance of excess cash paid into the electronic cash ledger.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.