Loading

Get Form Gst Reg-02 - Gst Marg

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

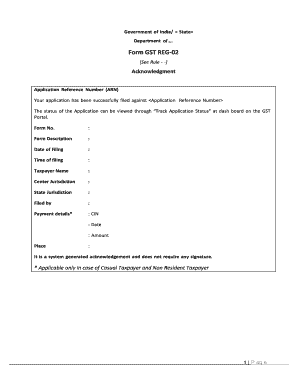

How to use or fill out the Form GST REG-02 - GST MARG online

This guide will assist you in successfully navigating the online process of filling out and submitting the Form GST REG-02 - GST MARG. With clear, step-by-step instructions, users of all experience levels can complete the form with confidence.

Follow the steps to complete your form effortlessly.

- Press the ‘Get Form’ button to access the document and open it in your editing interface.

- Review the form’s description and fill in the required fields, such as the Form No. and date of filing, ensuring that all details are accurate.

- Enter your taxpayer name in the designated field, making certain it matches the name associated with your tax records.

- Indicate your center jurisdiction and state jurisdiction in the respective sections, selecting the correct options based on your location.

- Specify who has filed the form in the 'Filed by' section. This can be an authorized person or representative.

- If applicable, provide the payment details, including the CIN, date, and amount paid, if you are a casual or non-resident taxpayer.

- Review all entries for accuracy and completeness before finalizing your submission.

- Once you complete the form, you will have the option to save changes, download, print, or share the document as needed.

Start completing your GST REG-02 form online today for a seamless filing experience.

GSTR-9 is the annual return to be filed by taxpayers registered under GST. It is due by 31st December of the year following the relevant financial year, as per the GST law. It contains the details of all outward supplies made, inward supplies received during the relevant financial year under different tax heads i.e.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.