Loading

Get Flexible Endowment Plan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Flexible Endowment Plan online

Completing the Flexible Endowment Plan online is a straightforward process that requires accurate information and careful attention to detail. This guide will walk you through each section of the form, ensuring you understand what is needed to submit a complete application.

Follow the steps to successfully complete the Flexible Endowment Plan form.

- Click ‘Get Form’ button to access the Flexible Endowment Plan proposal form and open it in your preferred online editor.

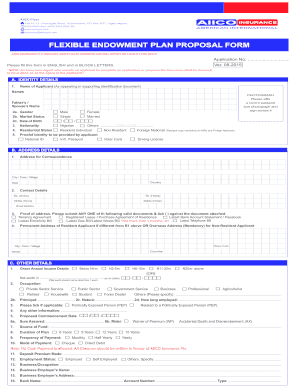

- Fill in the identity details section. Start by entering your name as it appears on your supporting identification document. Attach a recent passport-sized photograph in the designated area. Provide your gender, marital status, date of birth, nationality, and residential status. Make sure to include the necessary proof of identity.

- Complete the address details section. Specify your address for correspondence, including city, country, and state. Document your contact details, ensuring your telephone and email information are accurate. Provide proof of your address by selecting and attaching any valid documents outlined in the form.

- Fill the other details section by indicating your gross annual income and occupation. If applicable, mark if you are a politically exposed person. Provide any additional relevant information and the proposed commencement date for your plan.

- In the next section, indicate the sum assured, any riders you would like to include, and your source of funds. Specify the duration of the plan and the frequency of payment. Note that all payments should be made by cheque, without any cash transactions.

- Provide information regarding your employment status, business, and bank details. Ensure that your employment and business information are current and accurate.

- Answer the health-related questions truthfully, including any previous rejections for insurance applications and your current health condition. This section is crucial for assessing your eligibility for the plan.

- List your beneficiaries, specifying their names, percentage shares, and relationships to you. Make sure to include all necessary beneficiaries as outlined.

- Complete the names of references section, providing their names, occupations, addresses, and mobile numbers. This information may be required for verification.

- Read through the declaration carefully, ensuring that you understand its contents. Sign and date the form in the designated area, affirming your statements are true to the best of your knowledge.

- Once you have thoroughly completed the form, you can save your changes, download the completed form, print it for your records, or share it as required.

Start filling out the Flexible Endowment Plan form online today to secure your financial future.

Endowment plans may be good for people who want to use them to fund certain savings goals. But compared to other types of life insurance, endowment plans have higher premiums, and you may see lower rates of return on the investment portion of the policy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.