Loading

Get R7004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R7004 online

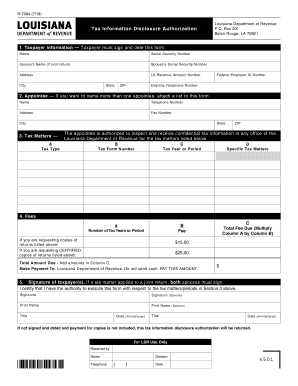

The R7004 form is used for tax information disclosure authorization with the Louisiana Department of Revenue. This guide provides step-by-step instructions to assist you in accurately completing the form online.

Follow the steps to successfully complete the R7004 form online.

- Click 'Get Form' button to obtain the form and open it for completion.

- In the taxpayer information section, provide your full name, social security number, and address, including the city, state, and ZIP code. If applicable, include your spouse's name and social security number, and your LA Revenue Account Number along with your federal employer ID number and daytime telephone number.

- For the appointee section, enter the name, telephone number, address, and fax number of the individual you are authorizing to receive confidential tax information. If there are multiple appointees, attach a list.

- In the tax matters section, provide the required details for each tax matter, including the tax type, tax form number, tax year or period, and specific tax matters. Specify the number of tax years or periods and any associated fees. Calculate the total fee due by multiplying the number of tax years/periods by the fee and entering this in the total fee column.

- In the fees section, indicate if you are requesting copies of returns, including the standard $15 fee or $25 for certified copies. Calculate the total amount due by adding the amounts in the total fee column.

- Both taxpayers must sign and date the form in the signature section. Print your names and titles where indicated. Ensure all information is correct, as forms that are not signed and dated, or lack payment for copies, will be returned.

- After completing the form, save changes, then choose to download, print, or share the completed R7004 form as needed.

Complete your R7004 form online today for efficient tax information management.

While Form 4868 is only related to individual income tax returns, Form 7004 covers a wide range of company income tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.