Loading

Get Debt Schedule Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Debt Schedule Template online

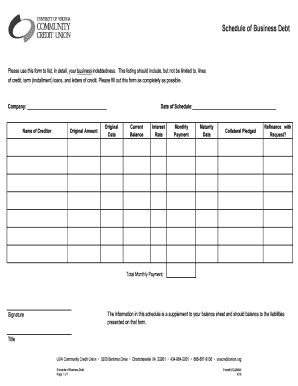

The Debt Schedule Template is a crucial document that allows businesses to systematically detail their indebtedness. By providing thorough and accurate information, you can ensure a clear understanding of your financial obligations.

Follow the steps to accurately complete the Debt Schedule Template.

- Press the ‘Get Form’ button to access the Debt Schedule Template and open it in your preferred online editor.

- Begin by entering the company name in the designated field at the top of the form. Ensure that the name corresponds exactly with your business registration.

- In the 'Name of Creditor' section, record the names of all creditors to whom your business owes money. Be as specific as possible.

- Fill in the 'Original Amount' field to indicate the total amount borrowed from that creditor.

- Enter the 'Date of Schedule' to signify the date you are filling out this form. This helps track changes over time.

- Record the 'Current Balance,' which reflects the amount still owed on the loan as of the date of the schedule.

- In the 'Interest Rate' field, provide the applicable interest rate for the debt. This rate is typically a percentage.

- Include the 'Monthly Payment' amount that your business is required to pay towards this debt.

- Document the 'Maturity Date,' indicating when the debt is scheduled to be fully paid off.

- List any 'Collateral Pledged' as security against the debt. This might include property, equipment, or other valuable assets.

- If you intend to refinance this debt, indicate that in the 'Refinance with Request?' section.

- Calculate and record the 'Total Monthly Payment' which sums up all monthly obligations across creditors.

- Review the entire form for accuracy and completeness. Ensure that your entries balance with your overall liabilities.

- Once satisfied with the information provided, save your changes, download a copy, print the form, or share it as necessary.

Complete your business documents online today for a streamlined financial overview.

What is a debt schedule? Simply put, a debt schedule details out all the debt a business has outstanding or available. It supplements the financials because it includes items that might not be on the Balance Sheet but, nonetheless, are valid debts that a bank would like to be aware of.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.