Loading

Get Ird - Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRD - Forms online

This guide provides detailed instructions on how to fill out the IRD - Forms online. It aims to ensure a clear understanding of each section and field within the form, allowing users to complete it accurately and efficiently.

Follow the steps to complete the IRD - Forms online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

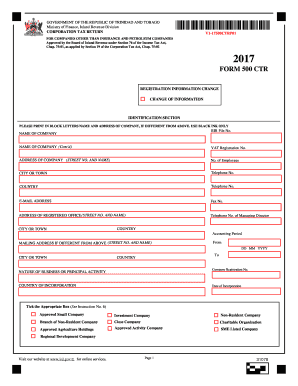

- Fill out the identification section. This includes providing the name and address of the company, BIR File Number, VAT Registration Number, telephone number, e-mail address, and registered office address. Use black ink only and print in block letters.

- Complete the accounting period section. Specify the start and end date of the accounting period for which the form is being filed.

- Next, specify the company registration number, nature of business, and the country of incorporation. Tick the appropriate box that describes the company type.

- Proceed to the computation of corporation tax/business levy due and paid section. Enter gross receipts/sales, chargeable profits, compute the corporation tax and double check for any reliefs applicable.

- In this section, you will declare the total reliefs and the corporation tax liability. If applicable, also compute the business levy liability.

- Complete the PAYABLE/REFUND section by entering the corporation tax and business levy paid. Calculate the total and indicate if there is a payable or refund situation.

- Sign the general declaration section to confirm the accuracy and completeness of the information provided. Ensure that the declaration is signed by an authorized individual.

- Review all entries to ensure accuracy, then save changes, download, print, or share the form as needed.

Complete your IRD - Forms online today for a seamless filing experience.

Printing your Tax Year Overview Log in to your online account. Follow the link 'view account'. Follow the link 'tax years' from the left hand navigation menu. Choose the year from the drop down menu and click the 'Go' button. Follow the link 'print your Tax Year Overview'.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.