Loading

Get Pay Ratio Surtax (prs) Schedule City Of Portland Business ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PAY RATIO SURTAX (PRS) SCHEDULE City Of Portland Business online

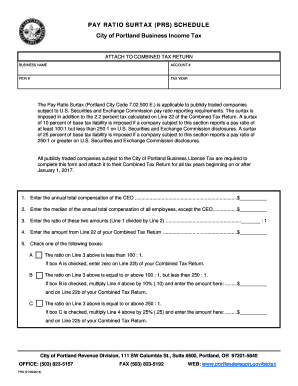

This guide provides detailed instructions for completing the Pay Ratio Surtax (PRS) Schedule for the City of Portland Business Income Tax. Designed for users with varying levels of experience, this resource will walk you through each step of the process to ensure a smooth filing experience.

Follow the steps to effectively complete your PRS Schedule.

- Click ‘Get Form’ button to access the form and open it in the designated online editor.

- Enter the annual total compensation of the CEO in the corresponding field. This is the total amount paid to the CEO for the fiscal year.

- Input the median of the annual total compensation for all employees, excluding the CEO, in the next field. This should reflect the earnings of all other employees.

- Calculate the pay ratio by dividing the amount from Step 1 by the amount from Step 2. Enter this ratio in the designated field.

- Transfer the amount from Line 22 of your Combined Tax Return to the corresponding field on the PRS Schedule.

- Select one of the following boxes based on the pay ratio calculated in Step 4: Box A for less than 100:1, Box B for between 100:1 and 250:1, or Box C for 250:1 or greater.

- If Box B or C is checked, calculate the relevant surtax: for Box B, multiply the amount from Step 5 by 10% and for Box C, multiply by 25%. Enter the calculated amount.

- Review all entered information for accuracy. Ensure that all required fields are completed appropriately.

- Once all information is confirmed, you can save your changes, download a copy for your records, print the form, or share it as needed.

Complete your PAY RATIO SURTAX (PRS) SCHEDULE online today to ensure timely and accurate filing.

Portland area companies are generally subject to three local/regional business taxes: City of Portland's Business License Tax: 2.6% of net revenue on gross receipts above $50,000. Multnomah County's Business Income Tax: 2% of net revenue on gross receipts above $50,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.