Loading

Get Bank Guarantee Format

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bank Guarantee Format online

This guide provides users with clear and concise instructions on how to fill out the Bank Guarantee Format online. Whether you are a seasoned professional or new to digital document management, these steps will assist you in completing the form accurately.

Follow the steps to complete the Bank Guarantee Format online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

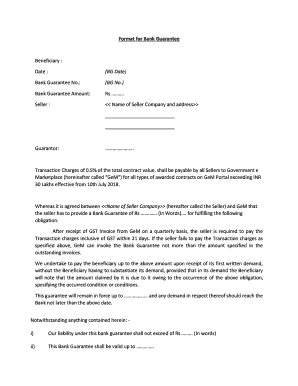

- Fill in the beneficiary section with the name of the person or organization that will receive the guarantee.

- Insert the date in the designated field to establish when the Bank Guarantee is being issued.

- Enter the Bank Guarantee number in the appropriate section for easy reference.

- Specify the Bank Guarantee amount, writing it numerically and in words to ensure clarity.

- Complete the seller section with the name and address of the seller company, making sure all details are accurate.

- Indicate the name of the guarantor, which is the party providing the guarantee.

- Review the section about transaction charges, ensuring the amount related to the total contract value exceeding INR 30 Lakhs is noted correctly.

- Detail the obligations of the seller, particularly regarding payment of transaction charges within the stated timeframe after receiving the GST invoice.

- Make certain that the section outlining the guarantee's validity period and liability limitations are correctly filled out.

- Provide the date when the document is being signed.

- Include the name of the bank and branch along with the signature, name, designation, and code number of the signing officer.

- Review the filled form for accuracy and completeness before proceeding to save the changes.

- Select the option to download, print, or share the form, as needed.

Complete your Bank Guarantee Format online today to ensure you meet all necessary obligations.

A bank guarantee is when a lending institution promises to cover a loss if a borrower defaults on a loan. The guarantee lets a company buy what it otherwise could not, helping business growth and promoting entrepreneurial activity. There are different kinds of bank guarantees, including direct and indirect guarantees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.