Loading

Get T1136

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T1136 online

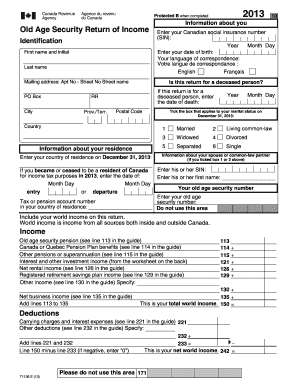

Understanding how to properly complete the T1136 form is essential for individuals involved with Old Age Security returns. This guide provides an easy-to-follow approach for filling out the form online, catering to users of all experience levels.

Follow the steps to effectively complete your T1136 form online.

- Press the ‘Get Form’ button to access the T1136 form and open it in your online editor.

- Begin by entering your personal information in the identification section. This includes your first name, initial, last name, and your Canadian social insurance number.

- Provide your date of birth using the specified format: year, month, and day.

- Select your preferred language for correspondence — either English or Français.

- Fill in your mailing address, ensuring to include apartment number, street number, street name, PO box (if applicable), city, province or territory, postal code, and country.

- Indicate if this return is for a deceased person, and if so, enter the date of death in the designated area.

- Complete the residence section by entering your country of residence on December 31, 2013, and any applicable dates for entry or departure from Canada for income tax purposes.

- Check the box that accurately reflects your marital status as of December 31, 2013.

- If applicable, provide your spouse or common-law partner's details, including their social insurance number and first name.

- Report your Old Age Security number and tax or pension account number in your country of residence, if necessary.

- Declare your total world income by completing the income section, summing amounts from sources outlined in the form.

- Input any deductions to be accounted against your income, detailing carrying charges and other deductions as instructed.

- Calculate your net world income by subtracting deductions from your total world income.

- In the refund or balance owing section, report on the Old Age Security recovery tax. If your net world income qualifies, record accordingly.

- Sign and date your form, ensuring you certify that the information is complete and accurate.

- Final steps include saving your changes, downloading a copy for your records, and either printing the document or sharing it as needed.

Complete your document online today for a hassle-free filing experience!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you are a resident of Canada and you received an NR4 slip: Report the income on your tax return. ... You can't claim “non-resident tax deducted” on your Canadian tax return. ... You should advise your financial institution that you are now resident in Canada so they can issue you the correct slips in the future.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.