Loading

Get Investment Questionnaire

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the investment questionnaire online

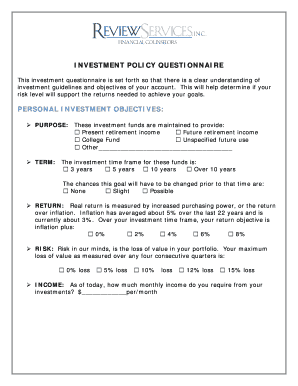

Completing the investment questionnaire online is an essential step in defining your investment objectives and risk tolerance. This guide provides clear instructions to assist users in filling out each section of the questionnaire accurately and effectively.

Follow the steps to complete your investment questionnaire.

- Click ‘Get Form’ button to obtain the form and open it for filling out.

- In the 'Personal Investment Objectives' section, select the purpose of your investment funds from the provided options. Consider your financial goals, such as present or future retirement income, a college fund, or other unspecified future uses.

- Indicate the investment time frame for your funds by selecting one of the options: 3 years, 5 years, 10 years, or over 10 years. Also, assess and choose the likelihood of changing this goal before the chosen time frame concludes.

- Define your return objective by selecting the desired real return over inflation. Options will typically range from 0% to 8%.

- Assess your risk tolerance by indicating the maximum potential loss you are willing to accept over any four consecutive quarters. Choose an option from 0% to 15% loss.

- Specify your monthly income requirement from your investments, entering the dollar amount in the provided field.

- Describe your primary investment objective using the checklist provided. Options may include current income with capital preservation, income with some growth, or capital appreciation.

- Assess your risk profile by circling a number that best represents your investor type, ranging from conservative to aggressive.

- If applicable, share any past experience of losing money on an investment and your feelings regarding that experience in the designated area.

- Review the generalized portfolio-performance records and circle the option that most closely aligns with your investment goals based on risk level, expected return, and worst-case scenarios.

- State at what point you would choose to terminate your advisor's services in the event of portfolio losses by selecting the appropriate option.

- Outline any restrictions you want on your investment funds in the designated space.

- Provide any additional information that should be considered when developing your investment portfolio in the space available.

- Finally, review the completed form, sign it, and enter the date. You can then save your changes and choose to download, print, or share the form based on your needs.

Complete your investment questionnaire online today!

An Investor Profile is a summary of an investor's financial goals, financial situation, time horizon, and risk tolerance. It can help investors, like you, select appropriate investments. In general terms, your profile defines the level of risk you are willing to take.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.